Payroll software for accountants, CPAs and payroll service bureaus

Your path to payroll success

Managing your clients’ payroll is no small feat—manual processes, inefficiencies, and compliance headaches can slow your firm down and expose you to risk. It’s time to streamline operations, increase profits, and wow your clients with IRIS payroll software. Packed with automation and supported by US-based payroll experts, you’ll have everything you need to stay ahead and deliver exceptional results.

-

Boost Efficiency

Automate processing tasks to save time, reduce errors, and cut costs.

-

Simplify Compliance

Stay effortlessly compliant with automated tax calculations, filings, and real-time updates on new legislation.

-

Enhance Usability

Simplify payroll with user-friendly design, self-service portals, and mobile access.

Features

Payroll software that pays off—for you and your clients

-

Efficiency

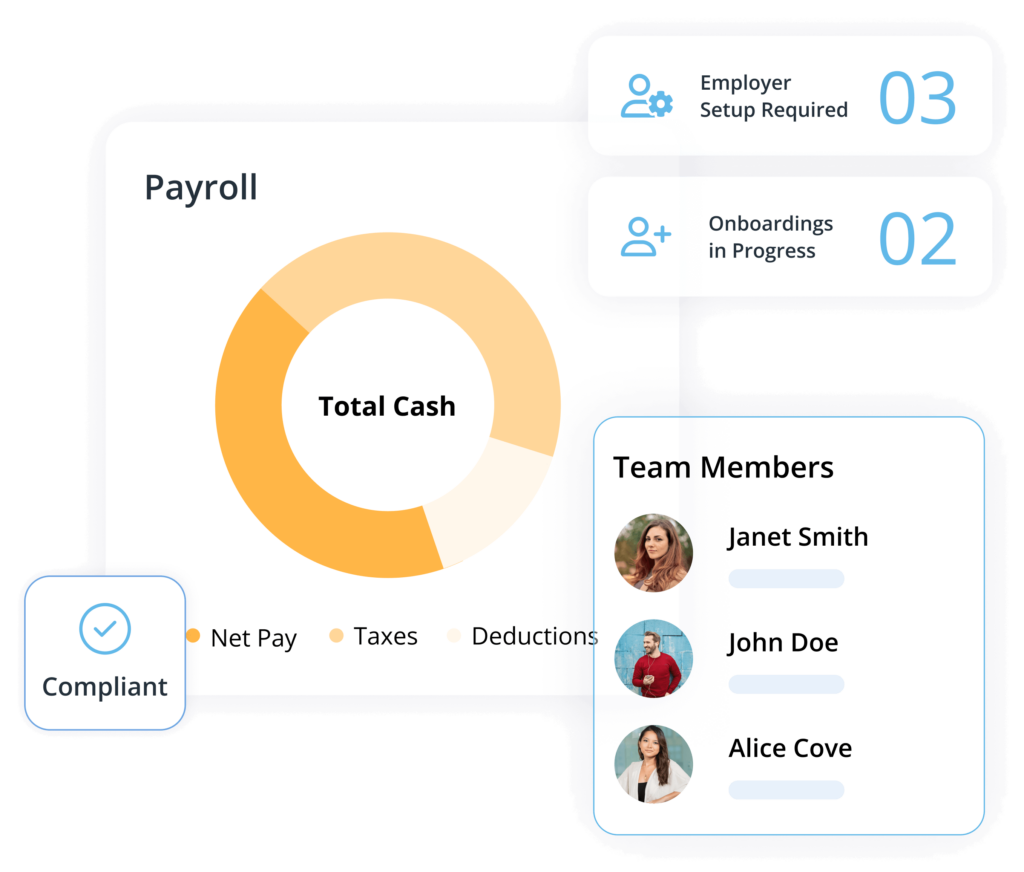

Automated processes to ease your workload

Automate time-consuming tasks like tax calculation, direct deposits and e-filing to save time and streamline operations.

- Onboard new clients and easily manage high-volume processing

- Operate with a smaller team, lowering costs without sacrificing productivity

- Improve calculation accuracy and reduce business risks

- Free up internal resources to expand your services

-

Support

Expert support, every step of the way

When you’re delivering critical services, dependable support makes all the difference. With IRIS Payroll Software, you get:

- US-based experts who truly understand your business

- A dedicated account manager backed by a familiar support team

- Support with implementation, setup, and data migration

-

Functionality

Features built to impress

Wow your clients with features and functionality that set your firm apart.

- Offer a modern, user-friendly interface and self-service portal

- Access payroll functions on the go with a mobile app and push notifications for you and your clients

- Connect with tools like QuickBooks, Xero, Sage, and Swipeclock to improve data flow and customer experience

- Download the IRIS Payroll Software brochure to learn more

-

Compliance

Compliance made simple

Keep up with all payroll legislation automatically, so you can focus on growing your firm without the risk of fines.

- Support calculations and compliance for federal and all 50 states

- Automate direct deposits, tax payments, and tax filing to ensure on-time delivery

- Get real-time platform updates whenever legislation changes

- Provide secure online portals for employees to access their payroll info

- Use flexible reporting tools to streamline operations and maintain transparency

-

Usability

Intuitive by design

Designed with ease of use in mind, IRIS Payroll Software simplifies payroll management.

- Automate repetitive tasks like tax filing, direct deposits, and W-2 e-filing

- Minimize data entry with batch processing and exception-based workflows

- Access payroll data anytime, anywhere, via the mobile app

- Simplify client communication with one-click emails and employee portals

- Sync with other systems to streamline workflows across your firm

Automated processes to ease your workload

Automate time-consuming tasks like tax calculation, direct deposits and e-filing to save time and streamline operations.

- Onboard new clients and easily manage high-volume processing

- Operate with a smaller team, lowering costs without sacrificing productivity

- Improve calculation accuracy and reduce business risks

- Free up internal resources to expand your services

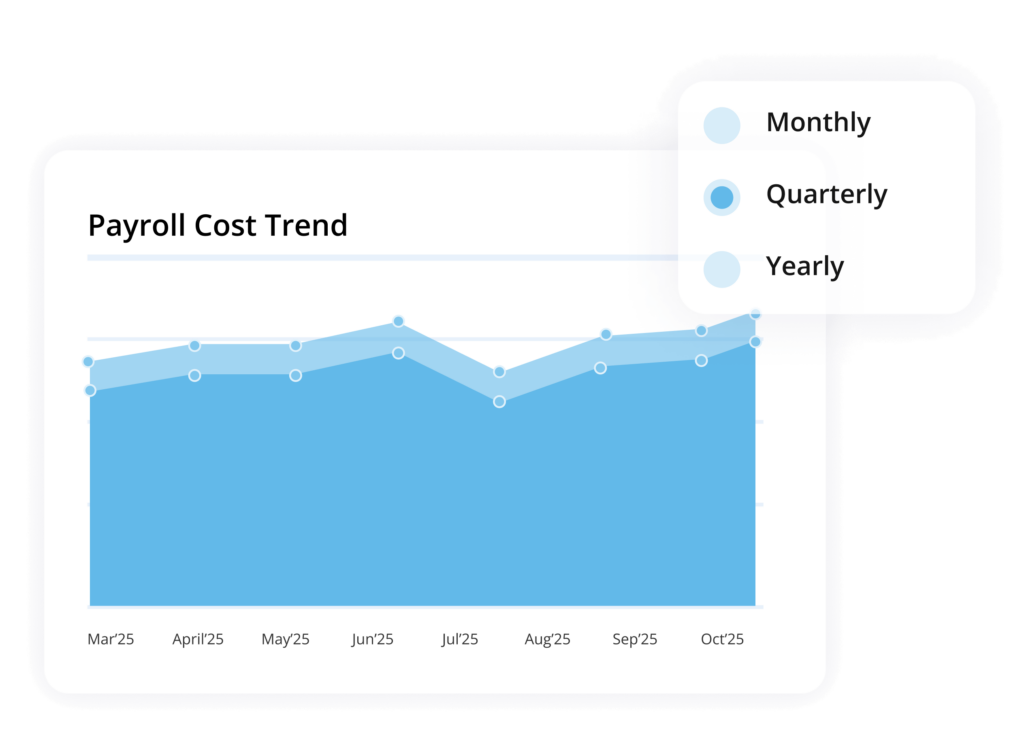

Payroll software reporting

Make informed decisions with advanced reporting

Take control of payroll strategy with advanced reporting tools that deliver clear insights into accuracy, compliance, and operational trends.

- Access pre-built payroll, compliance, and employee reports or build custom reports tailored to your needs

- Keep clients in the loop with automated employer and employee emails

- Safeguard critical documents with Cloud Cabinet, our secure, cloud-based storage solution

Buyer’s guide

Payroll software buyer’s guide

Why do 40% of small businesses face payroll penalties every year? Outdated systems and manual errors. See what features and functionality your payroll platform needs to ensure compliance, streamline operations, and keep your clients happy.

Frequently asked questions

-

IRIS Payroll Software features an open API architecture, allowing seamless integration with accounting platforms like QuickBooks®, QuickBooks® Online, CS Accounting, and Peachtree. Users can also export data to other systems via CSV files for added flexibility.

Beyond accounting, IRIS easily integrates with time and attendance programs, HR systems, pay-as-you-go workers’ comp, and 401(k) services, ensuring smooth payroll data exchange across your business tools.

-

Yes. Whether your clients need a full HCM platform or just key workforce management tools, IRIS payroll has you covered with:

- Applicant tracking

- Employee onboarding

- Employee HR portal

- ACA compliance tools

That means less hassle and smoother HR processes—so your clients can manage their workforce with ease.

-

If your current payroll software feels outdated, lacks essential features, or can’t keep up with your growing business, it’s likely time for an upgrade.

Here are key signs you should consider upgrading your payroll software:

- Excessive manual data entry or outdated processes

- Compliance issues due to missed software updates when legislation changes

- Poor customer support that leaves you hanging when issues arise

- No updates or new features in over a year

- Frustration or dissatisfaction from your clients or staff

While switching payroll software might seem daunting, delaying the decision can make the process even more challenging. With IRIS Payroll Software, a strategic, well-planned conversion with our Professional Services Team minimizes disruptions and sets your business up for long-term success.

-

The best software depends on your firm’s size, needs, and client base. However, most payroll service providers look for solutions that offer:

- Automation to reduce manual admin and improve efficiency

- Built-in compliance updates to ensure payroll is always accurate

- Client-friendly features like self-service portals or mobile app access

- Integrations to sync payroll with wider systems

IRIS Payroll Software is a smart choice for accounting firms and payroll providers looking for payroll software—it checks all these boxes and more.

-

Absolutely. Upgrading your payroll software doesn’t have to be stressful—our team makes the transition easy, with zero disruptions to your payroll services.

With IRIS, you get:

- Customized client setups tailored to your needs

- Dedicated data migration support from payroll experts

- Bespoke staff training to get your team up to speed

- Ongoing post-onboarding support to help maximize your new system

The secret to a hassle-free switch? A partner that gets it right the first time. Discover how easy it is to move to IRIS Payroll Software.

-

IRIS Payroll Software automatically monitors legislative updates worldwide and applies changes directly to the system.

This keeps your payroll processing compliant, no matter where your workforce is located. Even better—you don’t need to track updates yourself. The software handles it all for you.

-

Book a demo

Transform your firm’s payroll services

Why wait? Reach out today and book a demo tailored to the needs of your payroll service bureau or accounting firm.

Related products

-

Software to grow your payroll business

Streamline high-volume payroll processing with a cloud-based solution built for payroll bureaus, accountancy firms and CPAs.

-

Everything you need for high-performance payroll

Automate payroll workflows, integrate essential tools, and simplify management with software designed for accountants and bureaus.

-

Full-service payroll services for accounting firms

Offer payroll services to your clients—without the workload or compliance risks. Partner with a managed payroll provider that works as an extension of your team.