Trusted by global businesses like yours

International payroll solution

Global payroll services without borders

Managing global payroll doesn’t have to be overwhelming.

From currency conversions to local laws, our in-country payroll experts handle the complexity for you—ensuring everyone gets paid on time and in compliance with local legislation.

-

Local legislative compliance

Stay compliant with ease. Our local payroll specialists handle regulations and benefits, so you don’t have to.

-

Tailored payroll support

Your dedicated payroll manager is just a call away—your single point of contact for global support.

-

Global expertise, local knowledge

Get the best of both worlds. Our experts combine global reach with local know-how to unlock your team’s full potential.

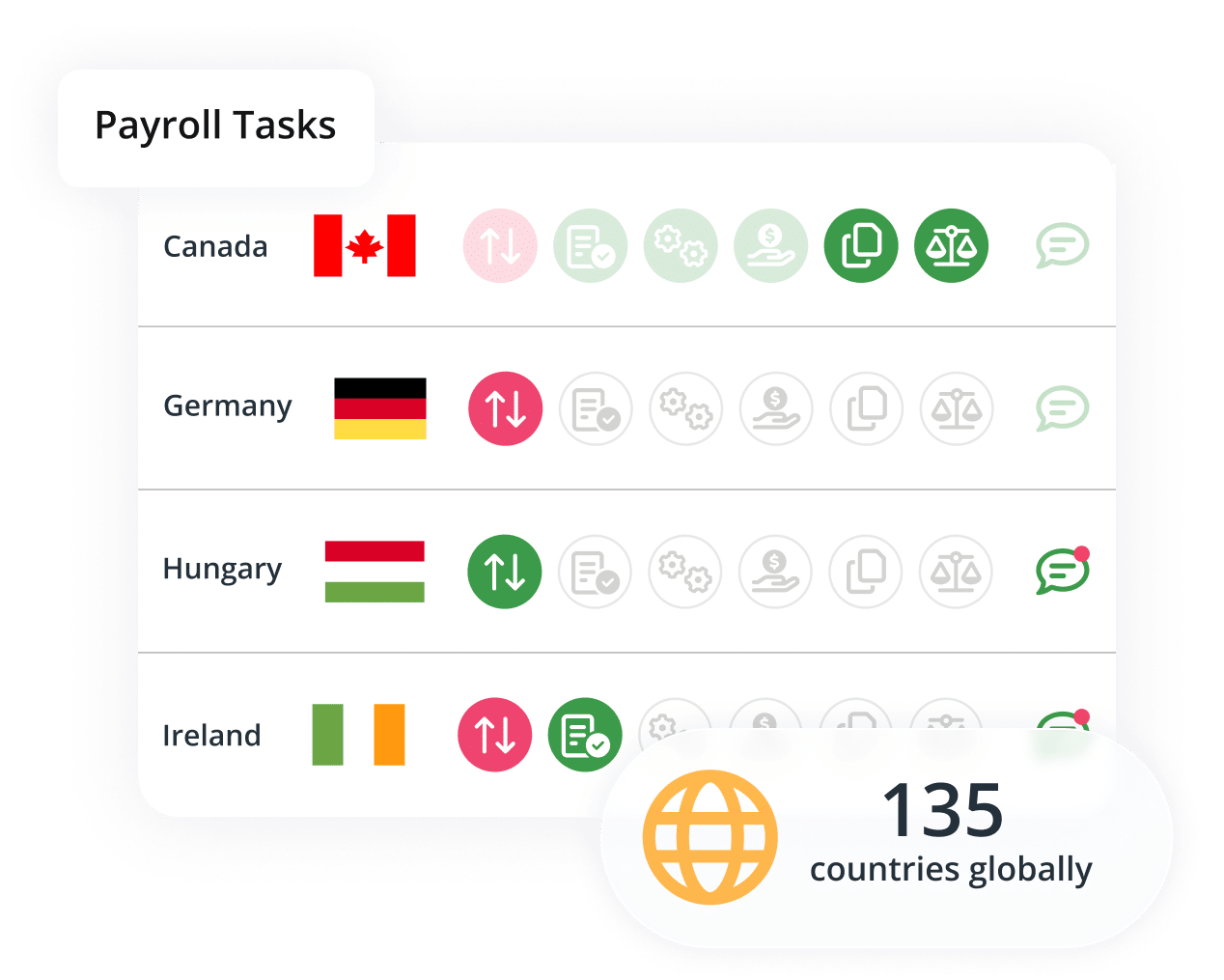

Global payroll portal

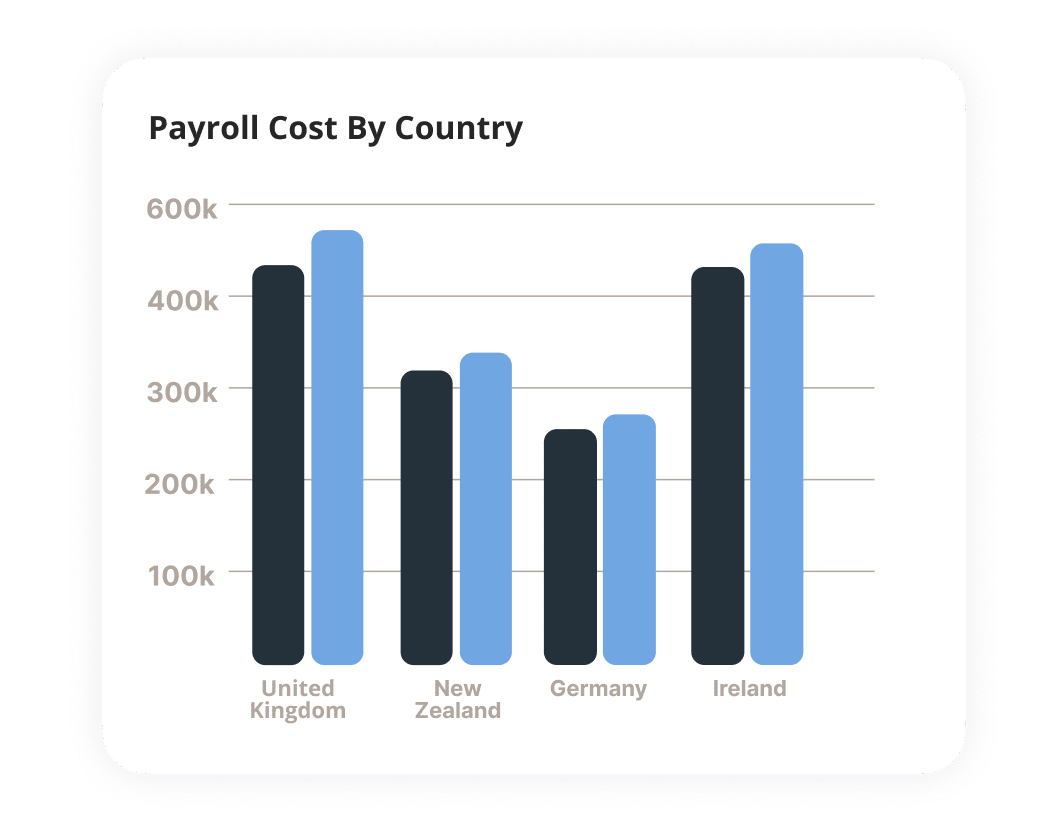

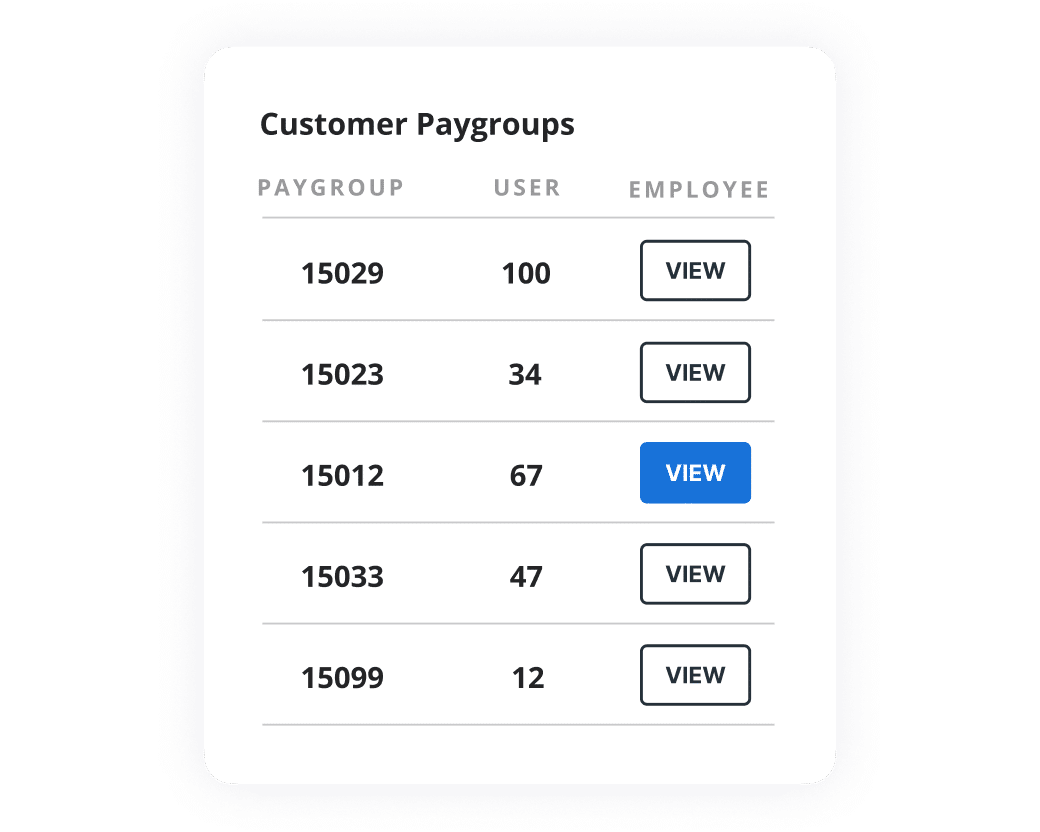

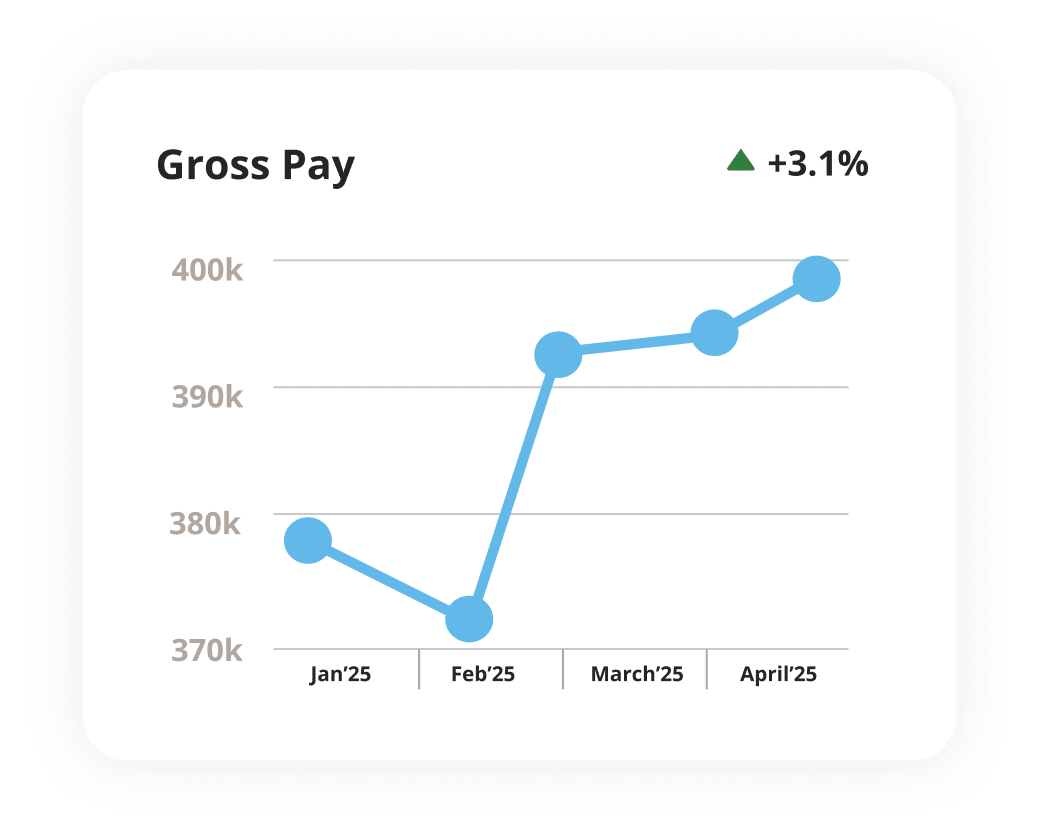

Centralized global payroll reporting

See everything in one place with IRIS Engage, our secure, cloud-based payroll portal offering you complete control.

- Easily access, review, and update payroll data with an intuitive dashboard

- Create custom reports in any currency and ensure local compliance

- Share and analyze payroll data through a secure, unified portal

Frequently asked questions (FAQs)

-

Managing payroll across multiple countries can be complex, but a global payroll service simplifies the process. It ensures employees get paid accurately and on time, no matter where they are, while keeping your business fully compliant with local tax and employment laws. With IRIS Global, you get a centralized payroll solution that standardizes reporting, automates payments, and ensures seamless international payroll management.

-

We offer the best of both worlds—local experts in-country and global support centers in key regions. This means you get real-time assistance from teams who understand your local payroll regulations while benefiting from extended global coverage.

-

Yes! We know how important it is to have someone who truly understands your business. That’s why we provide a dedicated payroll expert who will be your go-to contact for all payroll-related questions and support.

-

Our global payroll service takes care of everything—salary processing, tax and compliance management, automated payments, reporting, and seamless integration with HR and accounting systems. We handle the complexity, so you don’t have to.

-

The cost of global payroll depends on the country and the services you need. Our payroll processing starts from as little as $300 per month, with coverage in over 135 countries. Get in touch for a custom quote tailored to your business.

-

On average, we can get your global payroll system up and running in 10 weeks. Need it faster? Let us know, and we’ll work on an accelerated setup to meet your timeline.

-

Running payroll in multiple countries means dealing with different tax laws, labor regulations, and payment processes. By outsourcing payroll, you reduce compliance risks, save time, and ensure accurate, timely payments—without the stress. Our payroll experts handle it all, so you can focus on growing your business.

-

Absolutely! Our Engage global payroll platform connects seamlessly with leading HRIS and accounting software, ensuring smooth data flow and reducing manual work.