Less payroll stress, more peace of mind

Simplify operations with payroll services that handle tax compliance, payments, and admin.

-

Less admin

No more payroll processing, payment errors, and compliance headaches. Our experts handle everything behind the scenes, so you can focus on your business—not paperwork.

-

More accuracy

On-time payments, tax filing, and real-time reporting—all handled by payroll experts. No miscalculations, no missed deadlines, just payroll done right.

-

Zero stress

With a dedicated payroll team, secure portals, and seamless automation, we take the worry out of payroll—so you can run your business with confidence.

Trusted by 90,000 organizations like yours

IRIS Payroll Services

Your trusted payroll partner

Get more than a provider—partner with an industry leader trusted by accounting firms, small and medium businesses and global organizations. With expert payroll management services and dedicated support, you can focus on growth while we keep payroll running seamlessly.

IRIS Payroll Services

Payroll made simple. Growth made easier.

Take the complexity out of payroll management for your accounting firm or growing business.

-

Payroll for accounting firms

Offer payroll without the overhead. Let us be your payroll back office that handles compliance, payments, and payroll tax filings for your clients—so your firm can focus on your core accounting services.

-

Payroll for small to medium businesses

Payroll shouldn’t slow you down. Run your business with ease and confidence while we process payroll, manage tax compliance, and reporting.

-

Payroll for global businesses

Expanding globally? Simplify international payroll with local tax expertise, compliance support, and secure employee payment processing in 135+ countries.

-

Get in touch

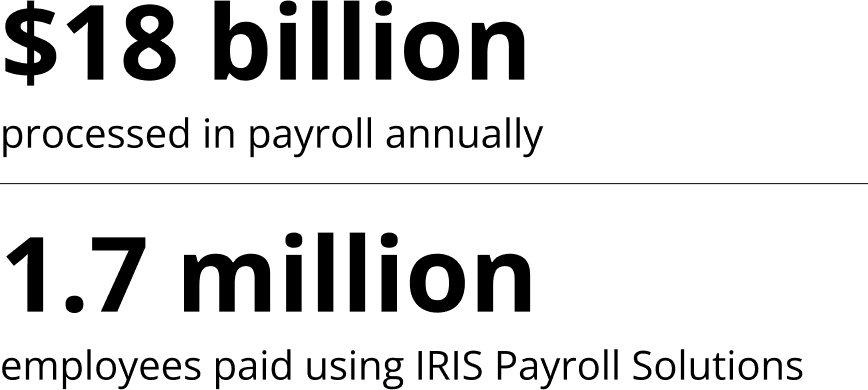

Powering payroll at scale

Every year, small businesses up to large global corporations rely on our payroll management services to process billions in payroll and pay over a million employees. With powerful automation, built-in compliance, and expert support, we help you run payroll with confidence—no matter your size.

Frequently Asked Questions (FAQs)

Get answers to the most common questions about payroll management services.

Need help choosing? Our Payroll Software Buyers Guide walks you through what to look for.