Payroll that works for you

Trusted by 90,000 organizations like yours

Pick your payroll solution—software, full-service, or global

-

Payroll Software

Run payroll with software that’s efficient, compliant, and built for accountants, CPAs, and payroll service bureaus.

-

Managed Payroll Services

Complete payroll services for accountants and CPA firms. Ensure accurate, timely payroll processing and tax compliance for your clients, so you can focus on your core accounting work.

-

Payroll & HCM Services

Full-service payroll solutions for small to medium businesses. Take payroll off your plate, so you can focus on running your business.

-

Global Payroll Services

Payment and managed payroll solutions for organizations expanding globally. Pay your team on time, in the right currency, and in compliance with local legislation.

Your proven partner for all things payroll

-

Payroll, simplified

Managing payroll shouldn’t be a headache. Whether you need full-service support or payroll software that automates the process, IRIS makes it easy to handle payments, tax compliance, and admin—so you can focus on growing your business.

-

Compliance without complexity

With deep expertise in payroll laws across multiple states, countries and industries, IRIS helps you stay ahead of ever-changing regulations. Reduce risk, avoid penalties, and ensure employees get paid on time—no matter where they are.

-

Support every step of the way

Payroll isn’t just about software—it’s about having the right partner. With dedicated support, expert guidance, and seamless integrations, we’re here to help you navigate payroll with ease.

-

Get in touch

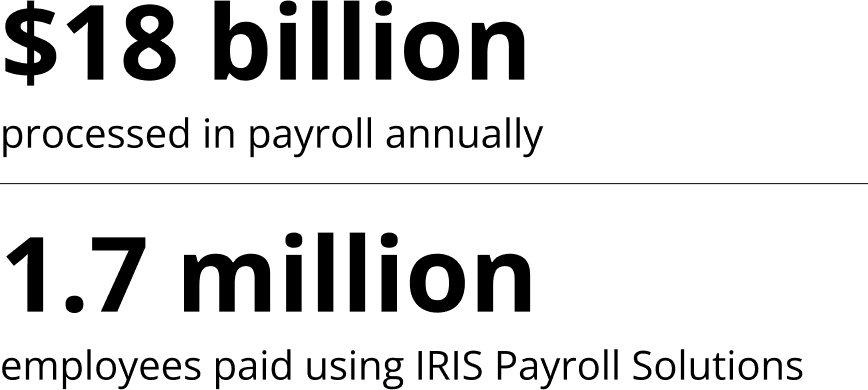

Powering payroll at scale

Every year, organizations rely on our business payroll solutions to process billions in payroll and pay over a million employees. With powerful automation, built-in compliance, and expert support, we help you run payroll with confidence—no matter your size.

Frequently Asked Questions (FAQs)

Learn more about the benefits of payroll solutions for businesses, accounting firms or a payroll service bureaus.

Some businesses handle payroll in-house using payroll software or a payroll team

Not sure which approach is right for you? Check out our blog “In-House Vs. Outsourced Payroll: What’s the Difference?”

Need help choosing? Our Payroll Software Buyers Guide walks you through what to look for.