Lock in payroll data security for your organization

Updated 13th January 2025 | 5 min read Published 2nd September 2024

Keeping your confidential payroll out of criminal reach is crucial – but how do you make sure you’re putting up a complete defence?

Find out how software, service models, and best practices can keep your payroll data locked down.

What solutions are there to ensure payroll data security?

However you’re running payroll, there are plenty of ways to protect your precious data.

You can use specialist software, outsourcing services, and security-conscious strategies to safeguard your payroll data – or ideally, a combination of these solutions.

Whether you’re a business paying your employees, a CPA or accounting firm running client payroll, or a payroll provider, you need to build an effective defence against data breaches.

Your incident response plan

In case of a possible data breach, an incident response plan can help you take swift, effective action. It can cover how you can:

- Detect a payroll data breach if it occurs

- Contain a breach and put a stop to any ongoing attack

- Eliminate the root cause (such as destroying malware)

- Restore systems and recover all possible data

- Take action to refine your data security approach.

Best practices to ensure payroll data security

Let’s look at some strategies for keeping your payroll data secure and your company fully compliant with legislation.

Control who can access payroll data

If someone were to stroll up to the front desk of a secure facility and request access, they’re not going to get very far if they’re not on the list of approved personnel.

The same is true with payroll data. By carefully controlling who has access to the system (and what they can do once they’re in), you’re minimizing the risk of foul play.

For example, if you’re a CPA running payroll for your clients, you could limit editorial access to your software system to a limited number of payroll managers.

Take advantage of software security features

Payroll management software often comes with nifty safety measures to help you mitigate risks against your payroll data’s security.

- Data encryption – By encrypting your payroll data, thieves won’t be able to access or use it even if they manage to steal it. And even if someone intercepts the data while it’s being shared, only the intended recipient has the key.

- Two-factor authentication (2FA) – 2FA is used when signing into software, requiring a second form of verification (e.g. a verification code sent to the authorized user). It means that even if hackers guess your password, they can’t gain entry to the system.

Use portals to share sensitive data

If you’re managing someone’s payroll, use an online self-service portal to update or amend any payroll-related information.

Dedicated portals – such as how you might log into payroll management software as a user – are encrypted, which means data can be shared safely.

When you send sensitive data via email (either in the text or as an attachment), it sits in your ‘sent’ items and becomes easy prey should your systems get hacked.

Perform regular audits and monitoring

To effectively safeguard against potential breaches or cyber-attacks, you need to carry out regular audits of your payroll systems and monitor ongoing activity.

Sometimes, data breaches can be hard to spot. A well-hidden piece of malware or a very careful criminal can siphon off data without setting off major alarms.

Monitoring and system audits allow you to see what's happening in real-time (alongside reviewing past activity). This ensures you can quickly identify any unusual actions or spot compromised systems.

Bring your people on board

It’s not all about technology – people are absolutely key to ensuring your payroll data remains safe and secure. But to help you achieve that, they have to know how. This might look like:

- Creating a document outlining data access, password management, and incident responses – and making it available to everyone

- Training staff on how to recognize phishing, secure personal devices for work, and understand the importance of data security.

- If you’re managing clients’ payroll on their behalf, educate clients on how to mitigate risk to payroll data (e.g. sharing employee data via the encrypted portal, rather than email).

Introduction to Payroll Data Security

For thieves and cyber criminals, your payroll data is a gold mine. Find out what it takes to protect your payroll data with this free guide.

Don’t fall for a phishing attack

Here’s how you, your employees, and your clients can avoid falling foul of a phishing attack.

- If an email seems suspicious, don’t click on links or open attachments

- Report suspected phishing emails to your manager or IT department

- Don’t use email to share sensitive data (e.g. social security numbers)

- Double-check emails, paying special attention to the email address or domain name.

Global payroll services for complete data security confidence

For businesses operating on a global scale, ensuring payroll data security can be even more challenging.

It’s why IRIS Global Payroll Services is so focused on keeping your data safe – and well out of reach of cybercriminals. From ensuring compliance with national and international regulations to rolling out advanced security measures, IRIS Global Payroll Services has your back – so you can focus on growing your business - Learn more

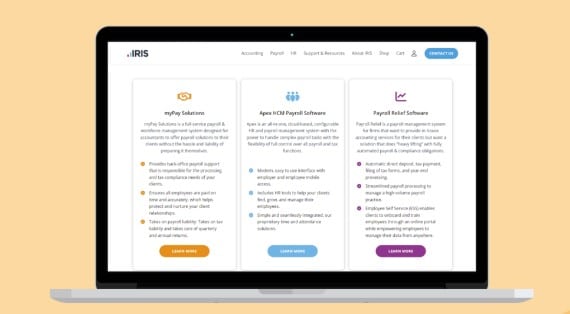

Unlock peace of mind with IRIS Payroll Solutions

To avoid data breaches, you need a payroll management partner with a complete solution and who’s ready to neutralize emerging threats.

IRIS Payroll Solutions is your partner in ensuring your client’s data safety, whether you’re looking for a hands-off service solution or powerful cloud-based software.